IFRS 17: the Data Management challenges

The international principle for accounting of contracts issued by insurance companies, postponed to January 1, 2023, marks a turning point in the insurance world. The aim of IFRS 17 is to ensure greater transparency by defining the principles for the recognition, aggregation, valuation, and accounting of all insurance and reinsurance contracts, as well as many investment contracts. Its introduction followed from other regulatory interventions, such as Solvency II and IDD/PRIIPS, that have already made the insurance market more complex and articulated. The new principle establishes unified standards for insurance contracts, related accounting, valuation, and reporting for the enterprises’ assets and liabilities. IFRS 17, therefore, makes the integration between financial, actuarial, and risk aspects even more imperative. It will significantly impact the collected data and its management in terms of processes, organization, and technology.

What is changing for insurance companies

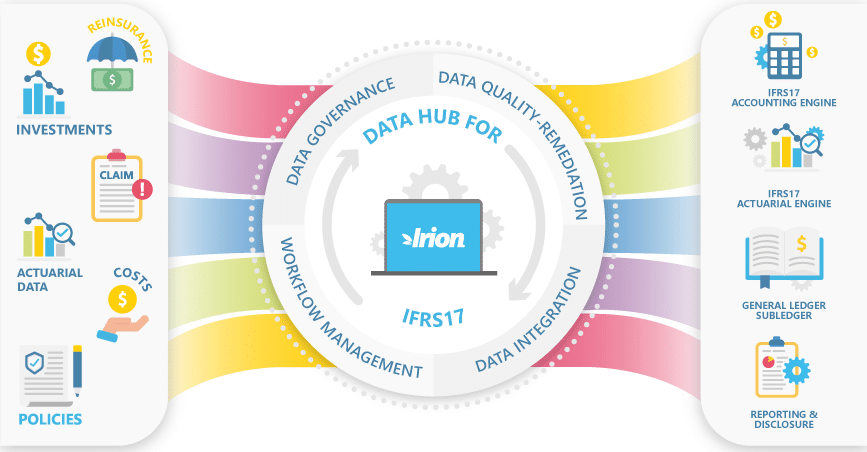

The Irion analysis also dwells on the effective changes for insurance companies. The toughest challenge, which will also involve different business areas, will be complex data management.

Most insurance companies collect enormous amounts of data from a variety of systems. It is necessary to take the evolutionary step from this silos structure towards an integrated approach as the timely access to data and the consequential ability to take effective decisions, giving a quick and coherent response to the market, will only become more and more crucial. Precisely for this reason, insurance companies will have to work on verifying the quality and granularity of the data they have and the integrating past, present, and future data. They will thus develop the right Data Governance strategy with appropriate tools and processes, transform the application architecture, and, with a careful eye, adopt new process automation technologies.

The importance of Data Quality and the support Irion can provide

The State of Data Science & Machine Learning study by Kaggle, the best known data scientist community in the world, evidenced that dirty data is among the main problems for 49.4% of professionals. However, this percentage rises to 57.5% considering only those working in the insurance sector. With IFRS 17, Data Quality, and thus data control and certification, will become even more of a priority for insurance companies.

Want to know more?

We will provide you with illustrative examples of how other organizations have already started their transformation.

DISCOVER IRION DATA QUALITY