Are you ready for the EBA Reporting Framework 3.0?

This article strongly focuses on Resolution Planning and aims at pointing out the impact of the novel regulations in terms of both organizations and processes. It also proposes a suggested approach to this challenge.

The new EBA reporting framework 3.0 comes in effect – in vigore from the reference date of June 30, 2021, and implements important regulatory developments the so-called banking package (CRR2, CRD5, BRRD2) contains. The new regulations revise large sections of COREP and FINREP and ensure better alignment with the disclosure requirements of Pillar 3. At the same time, new Resolution Planning templates are introduced. Here, there is a strong convergence of the MREL towards TLAC. Do not be deceived by the fact that the latter refers only to the G-SII. This novelty represents a considerable interest for the Banking sector. It will impact both reporting and disclosure areas and envisages quarterly data collection with stringent deadlines.

Background

In recent years, new requirements for intermediaries in the Banking sector have appeared. In particular, they concern the liabilities structure and the need to achieve the respective minimum requirements. Further detail is contained in:

- MREL (minimum requirement for own funds and eligible liabilities) appeared in 2014 concerns strictly Europe. Its reference body for continuous monitoring is the SRB (Single Resolution Board)

- TLAC (total loss absorbing capacity) appeared in 2015 and concerns Global Systemically Important Institutions (G-SII). Its jurisdiction is thus geographically broader. This requirement is defined by the Financial Stability Board (FSB).

As the so-called banking package (i.e., CRR2, CRD5, BRRD2) is approaching, it was recognized in 2019 that, despite some notable differences in purposes and calculation process, there is a significant overlap between data assets and the perimeter that concerns the corresponding regulatory requirements. This fact catalyzed the convergence between MREL and TLAC.

Within the legislative framework, the EBA deals with the actuating criteria and transforming the regulatory principles into special reporting requirements to integrate within ITS (Implementing Technical Standard). This will lead to further reporting and disclosure obligations for European banks.

Scope, objectives, and highlights

The main scopes affected by the initiative concern:

–Reporting Regolamentare: this is a new regulatory requirement. The time profiles addressing it must be strict. The regulatory reporting package comprises a total of 7 templates.

–Disclosure: in addition to the above, a new disclosure requirement is being introduced. It will be implanted into the data that Pillar 3 requires, with some features of considerable interest. The disclosure reporting package comprises a total of 5 templates.

In the final draft, EBA recognizes the correctness of the observation made by some of the respondents to the consultation regarding the overlap between the new requirements and the reporting already requested by the SRB for the Liability Data Reports (more precisely, in relation to the part of the Additional Liability Data Collection).

In turn, at the end of 2020, the Single Resolution Board significantly modified the structure of the Additional Liability Reports contained in the 2021 reporting cycle. It de facto anticipated most of the structures expected by the ITS as the reporting framework 3.0 comes in effect.

The premises above result in the following considerations:

- A non-replacement approach to current regulatory obligations in the area of Liability Data Reports (LDR) comes into being. It adds further data requests for the Banks

- The Additional Liability Reports (ALR) requested by SRB have a highly overlapping structure. One can therefore deduce (and even hope) that they will soon be dismissed, and the related data requirements will converge into the EBA reporting framework

- The data assets that emerge from the first analysis of the templates published along with the ITS final draft iprompt the assumption that the feeding sources currently used for producing the LDRs will play a central part in the fulfillment of further MREL/TLAC requirements.

It is worth noting that the new requirements also significantly affect the banks that are not systemically relevant. They are exempt from compiling some template columns yet required to comply with the new reporting and disclosure obligations in general.

Timeline

The first MREL/ TLAC consultation cited above was published on November 22, 2019. This abstract bases on the final draft dated August 3, 2020.

On March 18, 2020, the EBA has published an update of the reporting framework 3.0. It released the DPM and the taxonomy necessary to structure the reporting in XBRL format, as well as the validation rules to verify the data before sending it.

The new regulatory provisions commence in line with the adoption of the EBA reporting framework 3.0. That is, they come into force on the reference date of June 30, 2021 (simultaneously with the application of CRR2).

What concerns disclosure, the TLAC part will come into effect immediately after the ITS. The institutions that are not of systemic importance will have the time until January 1, 2024 to fulfill the MREL disclosure requirements. Nevertheless, it is legitimate to expect the interest of the intermediaries to produce the related templates for internal use in advance, also in terms of the possibility to obtain a large part of disclosure directly from regulatory reporting by applying the mapping criteria indicated by the regulator.

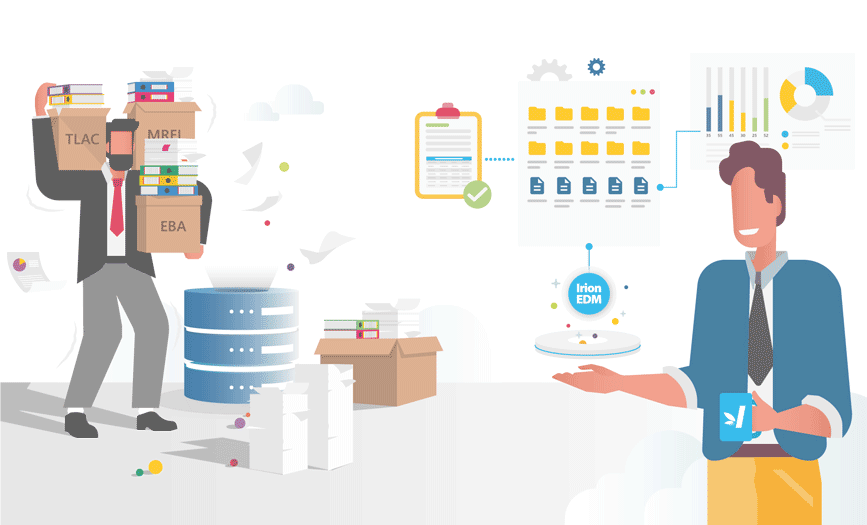

Why use Irion EDM to comply with the regulatory reporting requirements?

Irion EDM is a platform that allows optimizing the preparation of the necessary data to meet different regulatory compliance needs:

- A unique, automated, traceable, fast and repeatable solution offers users autonomy in managing regulatory changes and flexibility that facilitates integration with new regulatory reporting requirements in the future. In other words, it allows, instead of duplicating the data, to use an integrated approach that can sustain increasingly onerous workloads and deadlines.

- Irion EDM platform can connect to a wide range of sources. Hundreds of connectors are available for a variety of information and application structures, old and modern, structured and unstructured, on-premise and multi-cloud. Besides, there is a possibility to develop special connectors thanks to the platform’s powerful built-in functions. All the data available in the different sources is accessible from the modules as virtual tables.

- Process orchestration and simultaneous participation of several teams on the same project are made simple and functional. The platform is designed for use by IT technicians, Data Analysts, Data Officers and has special functions for different roles.

Want to know more?

We will provide illustrative examples of how others

have already started their transformation.